Content

Such assets are relevant only to the extent an element of control exists as exercised by a party to the marital estate. In such situations, an examination of both the balance sheet and related-party transactions may be necessary to determine whether or not the marital estate has been adequately compensated. Revenue is income earned from the sale of goods or services and is the top-line item on the income statement. Retained earnings, on the other hand, are derived from the bottom line, or profit of the income statement and is an important element in both the shareholder’s equity portion of the balance sheet and the company’s book value. Companies need to decide what is the best use of these funds at any given moment based on market conditions and economic realities.

Nonetheless, the accounting is similar to other deductions from the retained earnings balance. Once the transactions occur, companies will transfer the closing retained earnings balance to the upcoming year. Usually, these include special dividends that differ from the year-end allotments. In the above formula, companies may either have profits or losses during a period. The par value of a stock is the minimum value of each share as determined by the company at issuance. If a share is issued with a par value of $1 but sells for $30, the additional paid-in capital for that share is $29.

History of IAS 1

If your business has lost money from year to year or has paid out more distributions to shareholders than you’ve earned in profit, your retained earnings account will have a negative balance, also known as retained losses. As mentioned above, companies accumulate their profits or losses for several periods under this balance. However, they must deduct any dividends paid to shareholders from those amounts.

But, if you have two shareholders, and you paid out each $7,000 in dividends that month, you’ll be left with a negative amount. A net worth statement using the market valuation method measures the “solvency” of the business. If liabilities exceed assets and the net worth is negative, the business is “insolvent” and “bankrupt”. Stock dividends, on the other hand, are the dividends that are paid out as additional shares as fractions per existing shares to the stockholders.

Sample Balance Sheet: Acme Manufacturing

But there is also the prospect of very high profits and a substantial return on the investment. A venture capitalist will require a high expected rate of return on investments, to compensate for the high risk. A lease is an agreement between two parties, the “lessor” and the “lessee”. The lessee makes payments under the terms of the lease to the lessor, for a specified period of time.

- However, they are calculated by adding the current year’s net profit/loss (as appearing in the current year’s income statement) and subtracting cash and stock dividends from the beginning period retained earnings balance.

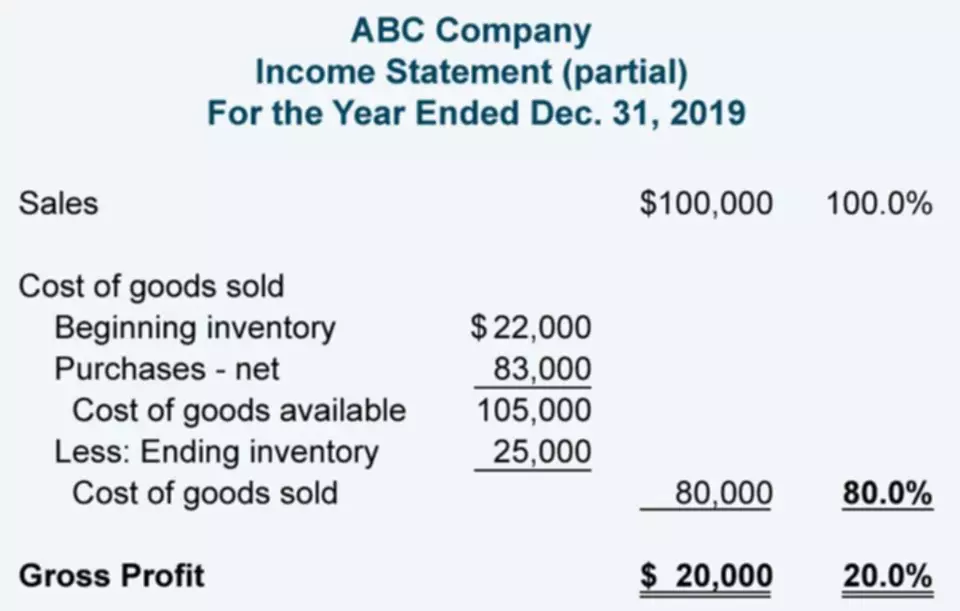

- Revenue is the income a company generates before any expenses are taken out.

- However, care must be taken to determine whether or not excess working capital truly exists.

- A business entity can have a negative retained earnings balance if it has been incurring net losses or distributing more dividends than what is there in the retained earnings account over the years.

- The banker must verify, as far as he is able to do so, that the amount required to make the proposed investment has been estimated correctly.

- No, retained earnings are not a current asset for accounting purposes.

On a company’s balance sheet, retained earnings or accumulated deficit balance is reported in the stockholders’ equity section. Stockholders’ equity is the amount of capital given to a business by its shareholders, plus donated capital and earnings generated by the operations of the business, minus any dividends issued. The figure is calculated at the end of each accounting period (monthly/quarterly/annually). As the formula suggests, retained earnings are dependent on the corresponding figure of the previous term.

Other Financial Statements

Before discussing where retained earnings fall on the balance sheet, it is crucial to understand what they are. It is easier to understand what retained earnings are after defining them. However, if an LLC doesn’t distribute all of its earning to its shareholders, it could be liable for supplemental corporation tax on any amount retained over $250,000. However, for other transactions, the impact on retained earnings is the result of an indirect relationship. Below is the balance sheet for Bank of America Corporation (BAC) for the fiscal year ending in 2020.

Note that financial projections and financial forecasting can provide an estimate of the retained earnings that might be available for reinvestment. That insight is just one benefit of a forecasting exercise for all-size companies. Retained earnings are calculated by subtracting distributions to shareholders retained earnings on balance sheet from net income. A net worth statement is only one of several financial statements that can be used to measure the financial strength of a business. Other common statements include the Cash Flow Statement and the Income Statement, although there are several other statements that may be included.