What’s the minimum ages importance of a face-to-face financial? Usually, 62. Before you earn this kind of loan, learn about the risks, and think other available choices.

Contrary mortgages usually are said because the a good way for cash-secured older residents and you may senior citizens to track down spending cash rather than having to give up their homes. Constantly, the minimum decades for criteria a face-to-face mortgage is actually 62. Oftentimes, you might be able to find you to definitely when you find yourself young, instance, shortly after turning 55.

But are these mortgage loans all that high? Reverse mortgages are complicated, high-risk, and you can pricey. And in of many things, the lender can also be foreclose. Bringing an opposing financial usually is not wise, even although you meet with the minimal decades criteria.

Exactly how Reverse Mortgages Performs

That have a face-to-face financial, you take away a loan up against the guarantee of your house. In place of having a consistent mortgage, the lending company helps make money for your requirements that have an opposite mortgage.

The mortgage should be repaid once you die, flow, transfer label, otherwise promote our home. Although not, for folks who violation this new regards to the borrowed funds offer, the lender you’ll phone call the loan owed before.

Whenever that you do not repay the borrowed funds due to the fact bank boosts they, you can clean out the property to a foreclosure.

House Security Transformation Mortgage loans

The newest Government Construction Government (FHA) means HECMs. So it insurance masters the lending company, maybe not the fresh new resident. The insurance coverage kicks when you look at the when the borrower defaults into the mortgage and also the family actually well worth adequate to pay off the lender completely as a result of a foreclosures product sales or other liquidation processes. This new FHA makes up the lender with the losings.

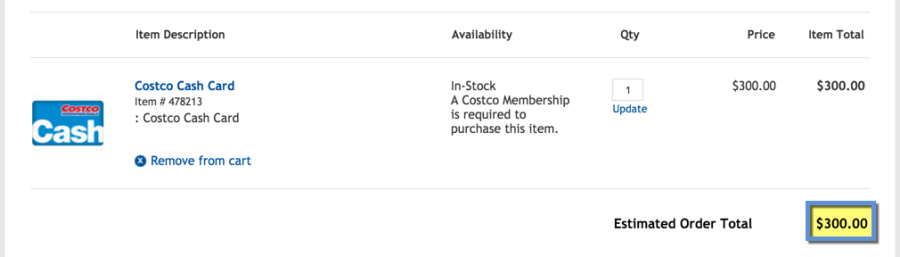

To locate a beneficial HECM, you ought to fulfill rigorous criteria for acceptance, plus the absolute minimum years demands. You might located HECM money when you look at the a lump sum (subject to certain limits), because the monthly premiums, since a line of credit, otherwise since a easy loans in Phil Campbell Alabama combination of monthly obligations and you may a line of credit.

Exclusive Contrary Mortgage loans

Proprietary reverse mortgages aren’t federally covered. This type of reverse home loan could be an effective “jumbo contrary financial” (simply those with high-worthy of house could possibly get them) or other style of reverse home loan, like that geared towards someone years 55 as well as over.

Other types of Contrary Mortgages

A different sort of contrary financial was a “single-use” reverse mortgage, and this is entitled good “deferred commission financing.” This sort of opposite financial are a would like-built financing getting yet another mission, including paying assets taxes otherwise buying domestic repairs.

Contrary Home loan Age Conditions and Qualifications

Once again, the minimum decades significance of a great HECM reverse mortgage was 62. There’s no top ages restriction to find an excellent HECM contrary mortgage.

Opposite mortgages don’t have credit otherwise earnings standards. The quantity you might use will be based upon your residence’s well worth, current rates, and your many years. As well as, exactly how much of your home’s well worth you could potentially extract try minimal. At the time of 2022, by far the most money provided by a HECM is actually $970,800. Including, a borrower might get simply 60% of your loan within closure or even in the first seasons, at the mercy of several exclusions.

- You need to are now living in the house as your dominant home.

- You must have big security on property or own the new household downright (meaning, you do not have home financing in it).

- You can not be unpaid toward a federal obligations, such as for example federal income taxes otherwise government student education loans.

- You ought to have money accessible to spend ongoing assets can cost you, such as house repair, property taxation, and homeowners’ insurance.

- Your property have to be from inside the great condition.

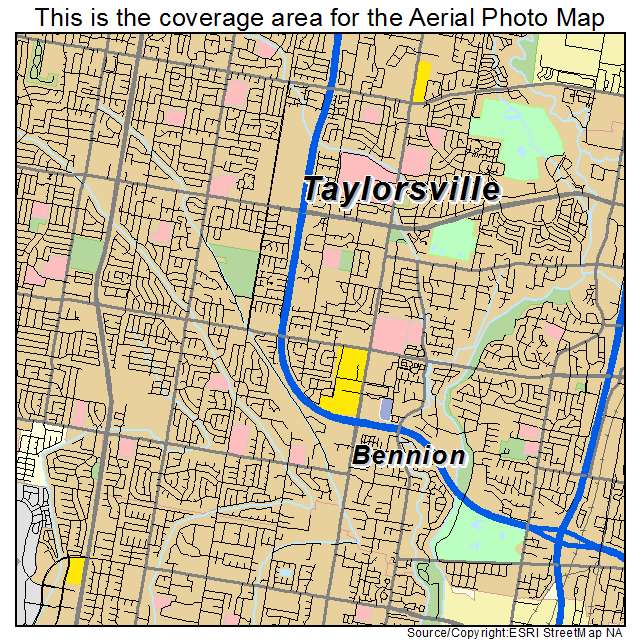

- The home should be an eligible possessions style of, particularly one-house.