Whenever the application form & files are filed, and the operating payment try paid back, the financial institution expert then assesses them. Residential target, Lay in which the guy/she is working,Back ground of company,Workplace & Home phone number. Note: A bank representative pays a visit to brand new applicant’s residence otherwise work environment to ensure his/their particular facts.

5. Strong Examining Files

Brand new certification, decades, and you will experience details. New deals made with the fresh applicant’s bank. The fresh monthly and you may annual income. The modern workplace as well as the particular employment he/she pursues. The kind of the team (applicable simply for a personal-employed). The capability to pay-off the loan amount towards lay appeal rates. According to the pointers mentioned above, the lending company finalizes and you may interacts the maximum loan amount the applicant can discover.

6. Brand new Sanction/Recognition Techniques

The new recognition otherwise sanction area is one of the most very important amounts regarding home financing process. This will possibly keeps a successful results otherwise will be denied. It-all relates to the financial institution. If it is not happy with any of the documents provided from the applicant, the probability of recognition converts reduced. But not, when the what you happens better, the loan was approved otherwise approved right away. We could give the reputation frequently.

7. Running The offer Page

When the financing was approved otherwise acknowledged, the financial institution then delivers a certified render letter, and that says next details: The loan amount that’s becoming approved. The pace for the complete loan amount. Perhaps the rate of interest was adjustable otherwise fixed. The new loan’s period info. This new setting away from mortgage repayments. Terms, regulations & standards of the house loan. The latest Greeting Backup

8. Control The home Records

Because the bring letter is actually commercially recognized by candidate, the lending company next centers on the house property the guy/she intentions to purchase. Regardless if this isn’t finalized, the brand new candidate can request for a time https://paydayloancolorado.net/aspen/ period to pick you to definitely. Once the home is picked, the newest applicant must Fill in most of the assets document Copies so you’re able to the financial institution & in addition to the arrangement on the manager of the home.

9. Courtroom Have a look at

Because assets documentation is actually recorded, the financial institution upcoming validates all of them to possess authentication. The original data files and you can duplicates try delivered to the latest bank’s attorney having an in-breadth have a look at. Only when the new attorney approves the submitted data because clear, upcoming everything about financial is useful. If not, the newest candidate could be questioned add more records having verification.

ten. Tech Webpages Valuation

Every financial is highly wary about the borrowed funds it lends and you can our home possessions it intends to funds. Which, a technological consider or a make sure was subsequent done. The financial institution will send an expert to search for the market value of the home your candidate intentions to pick. Now, this person you are going to be either a worker of financial otherwise a municipal professional or people away from an architect’s corporation.

11. The final Loan Price

Since the tech valuation is performed, the bank over most of the finally papers. The next step is and also make able the fresh draft getting finally registration of the home, lawer ensures brand new write is right towards candidate. The fresh attorneys of your own financial finalizes the mortgage data files while having all of them stamped. Specific financial institutions agree to check in the document from the document writter selected by applicant.

twelve. Finalizing The loan Agreement

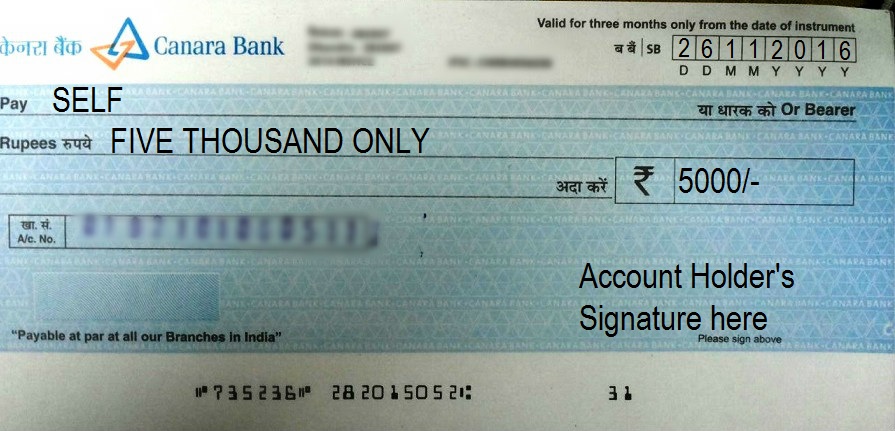

Following the records is done, brand new candidate needs to signal this new arrangement of the property mortgage. He/she has to submit brand new cheques (post-dated) towards the first cuatro days or the years the events enjoys agreed upon. That it stage is known as the fresh MOE (Memorandum regarding Execution) features a beneficial stamp responsibility in line with the county the fresh applicant is applicable at. Which obligations is paid back by applicant..